Welcome to Market Talk! I’m Liz Moore, President of Liz Moore & Associates, and today we’re going to talk about what’s happening in our local real estate markets as we move into the new year in 2024.

Welcome to Market Talk! I’m Liz Moore, President of Liz Moore & Associates, and today we’re going to talk about what’s happening in our local real estate markets as we move into the new year in 2024.

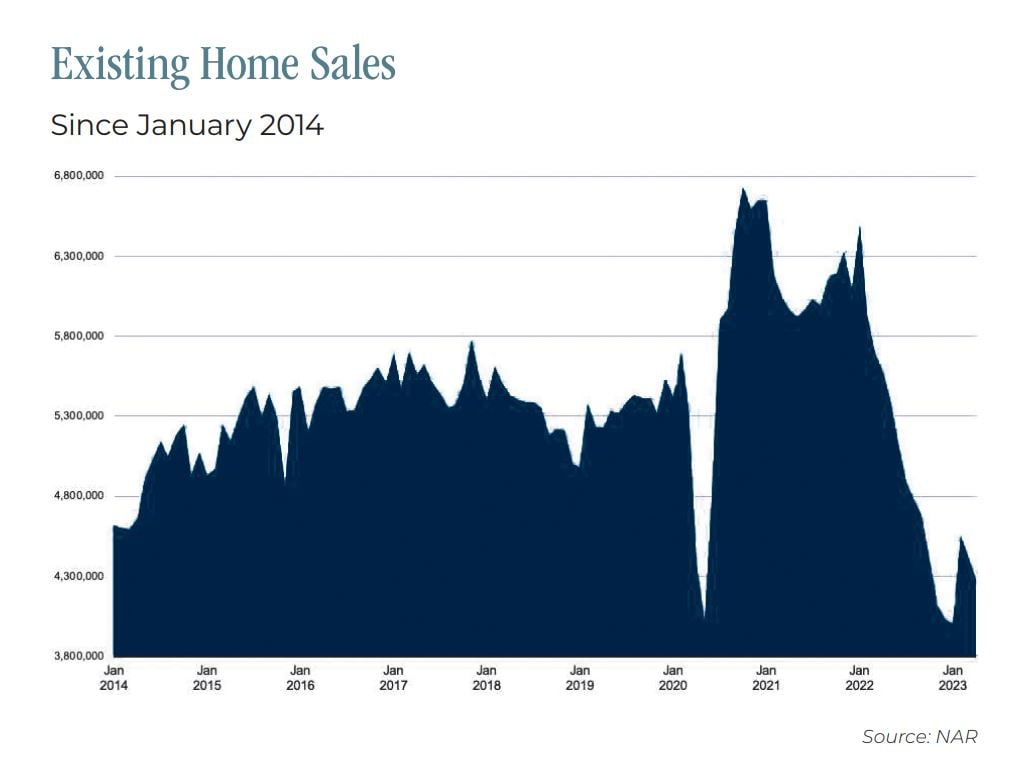

I’ve heard some reports that the U.S. will record the lowest number of sales in 2023 since 2008. The real estate market was definitely off last year, but it did NOT feel like 2008. There are a number of reasons for that: first of all, the pace of the market remained steady, because unlike 2008 there was plenty of buyer demand.

Back then, we had over 2 years of inventory available – last year the needle moved from less than 1 month to approaching 2 months. The result of that was that nearly one third of the market experienced multiple offers – good for sellers, not so much for buyers.

My prediction for 2024 is that it’s going to be a solid real estate year. I believe that for lots of reasons, but

here are the main 3:

1. Buyer Demand continues to remain strong. One reason for this is the huge number of people in the prime household formation phase of life – 72 million millennials, more than any other time in history. Household formation begins at 26, and the prime buying years for first timers is now 33 to 35.

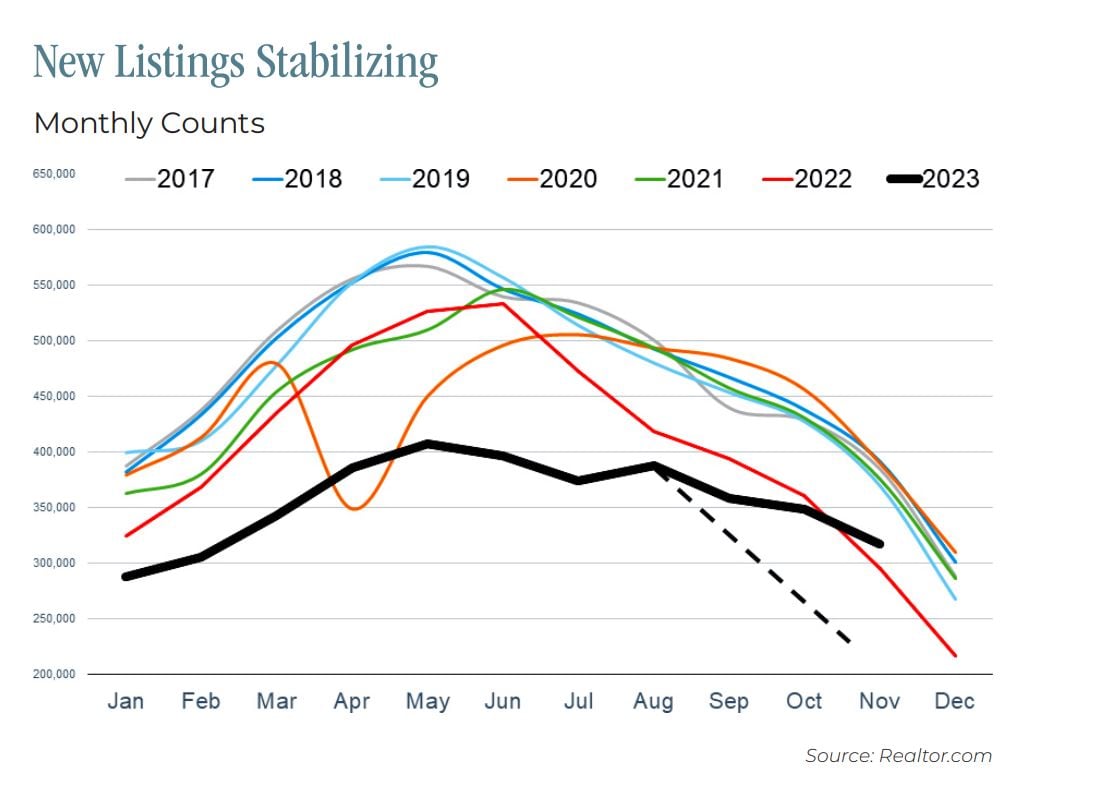

2. There is also a great deal of pent-up Seller Desire to Move. People love their low interest rates, but not necessarily their current houses. Many Americans put their moves on hold during the pandemic years, but life has moved on. During the past 2 years there have been almost 3 million marriages and 1.5 million divorces, 7 million babies born, and 7 million boomers turned 75, which translates to time to downsize. There were also 50 million job changes, and lots of flexibility as a result of new remote working opportunities. A lot of those sellers have put moves on hold because they don’t want to give up their 3% interest rates for rates that were hovering around 8%, but as we see those rates inch down, 6% seems like a bargain.

We’re already beginning to see new listings stabilize.

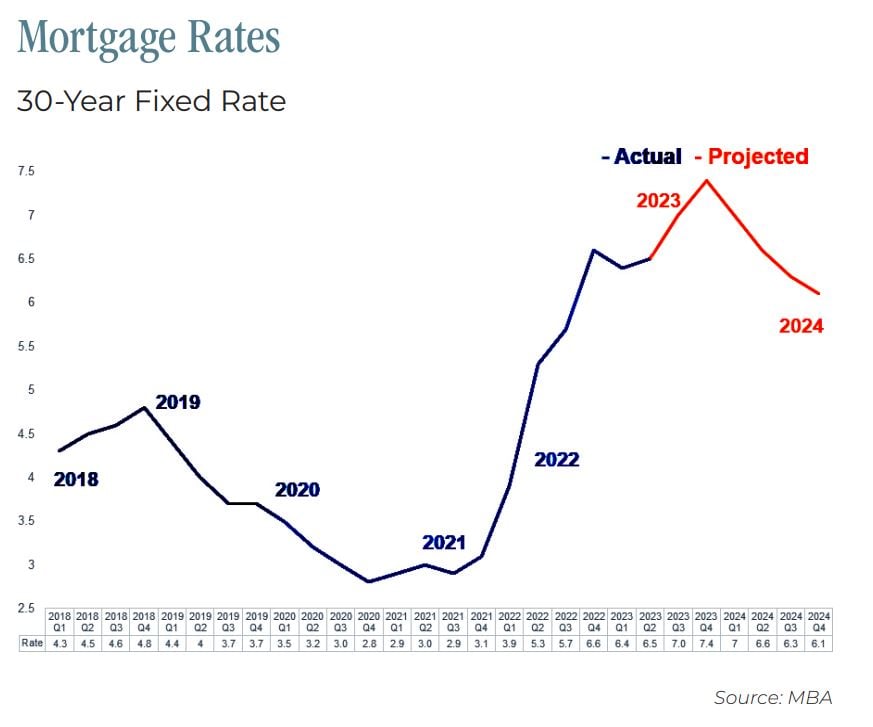

3. Interest Rates are finally headed down! And, all predictions are that they will continue to drop, very slowly, but consistently over the next 12 months. The combination of those 3 things mean better days are ahead; I

think it’s safe to say that we are at the bottom of the trough.

Let’s dig in and examine some of the underlying benchmarks and clarify exactly what is happening!

Interest Rates

Mortgage interest rates have been the story for the past 2 years. With a 5% swing upward since the end of 2021, causing many buyers to hit the pause button on their home search, we finally can see some relief in sight. Compared to rates approaching 8% in the Fall of 2023, we are now enjoying mid 6’s, which relative to the 2 year climb, feels relatively doable. Most industry experts predict that rates will continue to

fall over the next 12 months:

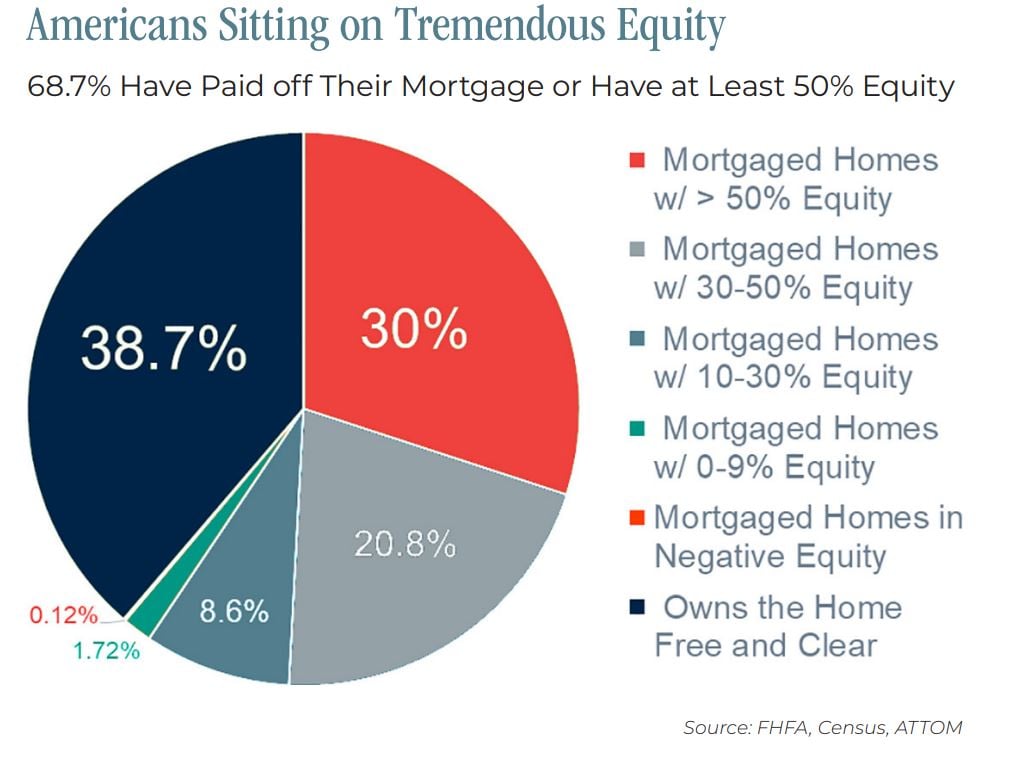

As interest rates become palatable again for buyers, we will see them return to the market. At the same time, those sellers who have been holding tight on the sidelines will begin dipping their toes in the market. Sellers are recognizing that their homes may never be worth more than they are right now, and that 2024 may be the ideal time to tap into their equity. Because of extremely strong price appreciation during the pandemic years, most homeowners have record high market values, and accordingly significantly more equity than they did pre-pandemic. Nearly 70% of homes are completely paid for, with the owners having no mortgage at all, or have at least 50% equity.

This record high equity creates an opportunity for sellers to trade up, and use their additional cash to either put down a larger down payment to offset interest rates, or to pay off other consumer debt that is carrying a

higher interest rate. Either way, overall monthly expenses can actually drop, despite the fact that mortgage rates will be higher on the new house.

That additional inventory will make ALL the difference, and should create a robust Spring market. My advice to sellers is to beat the market – I would recommend listing in February or March, to get ahead of the Spring rush which will undoubtedly bring lots of additional competition. By capitalizing on continuing low inventory, you’ll be able to maximize your home price and have a favorable negotiating position.

For buyers, the same is true. Get pre-approved early, and begin shopping before the traditional Spring rush begins, where there will be less competition for the property you want. Now is the time to shop for a lender carefully. Many local lenders are offering incentives to borrowers where they will offer a “free” refinance

when the inevitable rate drop begins. This creates a win-win situation.

We would love to meet with you to discuss what’s happening in the local market, and how it may affect your real estate plans for 2024. If you’re just curious about what your home may be worth in the current market, we would be happy to share our insights. Click here to get started!