By: Liz Moore

Welcome to Market Talk!

I’m Liz Moore, President of Liz Moore & Associates, and today we’re going to talk about what’s happening in the local real estate market. This past year was a roller coaster ride, and it has left many people questioning whether now is a good time to move. The market is actually pretty complicated these days, and it’s important to have a solid understanding of what’s happening and how it will affect YOUR move.

My goal is to bring some clarity about what’s really happening in the market, and how you can leverage that to accomplish your personal real estate goals.

So, let’s get to it!

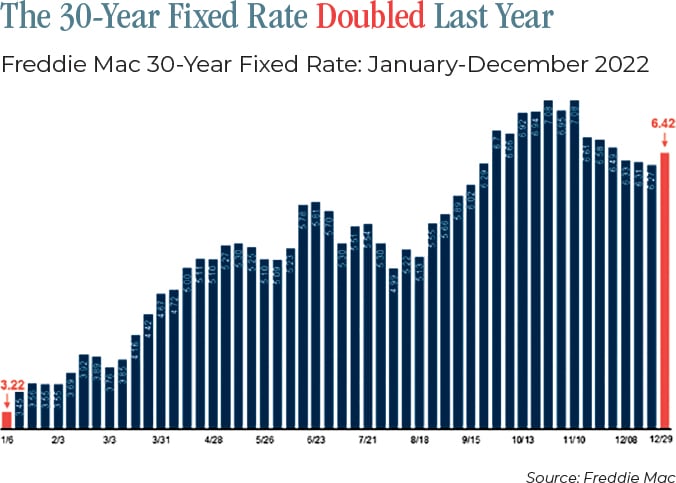

The biggest story last year has been the dramatic increase in interest rates. While that may have been a positive influence on our savings account ROI, it dramatically dampened the real estate market by causing prospective homebuyers to hit the “pause” button as they watched their monthly house payments significantly increase in record time.

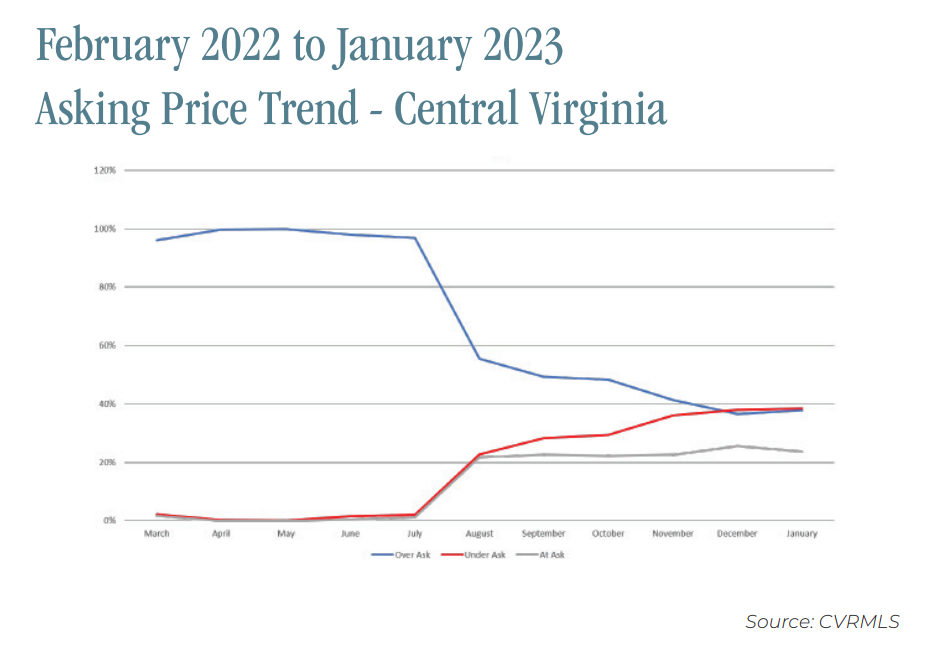

Fewer buyers in the market resulted in a slowdown in multiple offers (in many cases, but not all), which in turn slowed down the percentage of listings that are selling above asking price. For the first time in several years, buyers are once again in a bargaining position to ask for closing cost assistance from sellers, to negotiate repair requests from home inspections, and in some cases to even pay less than asking prices.

So, in a nutshell, the pendulum has swung back toward a more balanced market. You’ll see in the chart below that offers over asking are running less than 30% in our local market, while offers under asking have crept over 40% of all offers. It’s important to note that these trends differ based on price point and neighborhoods, and your REALTOR can counsel you on what is trending in the specific market you’re considering.

Encouraging News for Buyers

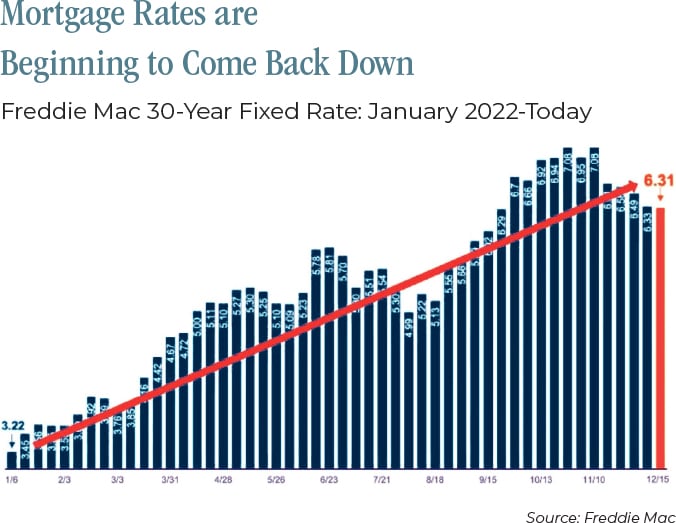

What does this mean if you’re interested in buying? It’s definitely good news. Although interest rates took a big jump last year, they have come down over a percentage point since the peak at over 7% last Fall. Several local lenders are marketing programs offering a credit toward a later refinance if and when rates do come down. There are also a number of creative financing options available, like an interest rate buy down or adjustable rate mortgages, that make ownership in the current climate even more affordable. Your REALTOR can review your options with you, and recommend a local lender who has such programs available.

For most, not having to pay thousands of dollars over list price, guarantee appraisals, and waive home inspections and repairs more than makes up for the increase in interest rates.

Perhaps even more important to weary buyers is that they have more choices than they have had for quite some time. Not only is inventory beginning to tick up, but the pace of the market has slowed, eliminating the frenzy that has characterized the past few years. This means that buyers can consider their choices in a far more reasonable market climate.

How About Selling?

For those considering selling this year, the market is a bit more complex. Inventory remains low (although we’re anticipating an increase in available listings as the Spring season warms up), which means sellers are still commanding strong prices, even when there aren’t bidding wars. And, for those sellers who will turn around and buy, it’s finally a market that will allow you enough breathing room to accomplish a door-to-door move.

My advice to sellers who are considering a move is to do it sooner rather than later. Local inventory is hovering just less than 2 months. The uptick in inventory may mean lower offer prices as as the market continues to cool.

As I said at the onset, the market is complicated these days, and it’s more important than ever that you have an experienced professional advising you. I recommend that sellers reach out to their REALTOR for an annual “equity check-up” to review the current market value of their home. That’s a great opportunity to discuss any improvement plans to see if the cost vs. value ratio makes sense, as well as explore what's happen in the mortgage world. Knowledge is Power!

Tags:

lizlocal-NorthernNeck-realestate, lizlocal-richmond-realestate, lizlocal-williamsburg-realestate, lizlocal-peninsula-realestate, MarketTalk